A Compliance & Risk Management Solution for Financial Institutions Banking Cannabis

NatureTrak’s comprehensive solution allows you to safely and profitably provide services to the cannabis-related businesses in your banking communities. Whether you are interested in driving revenue, capturing new market share, or simply maximizing efficiencies to scale an existing cannabis banking program, we can help.

Transform Your Compliance

Department into a Profit Center!

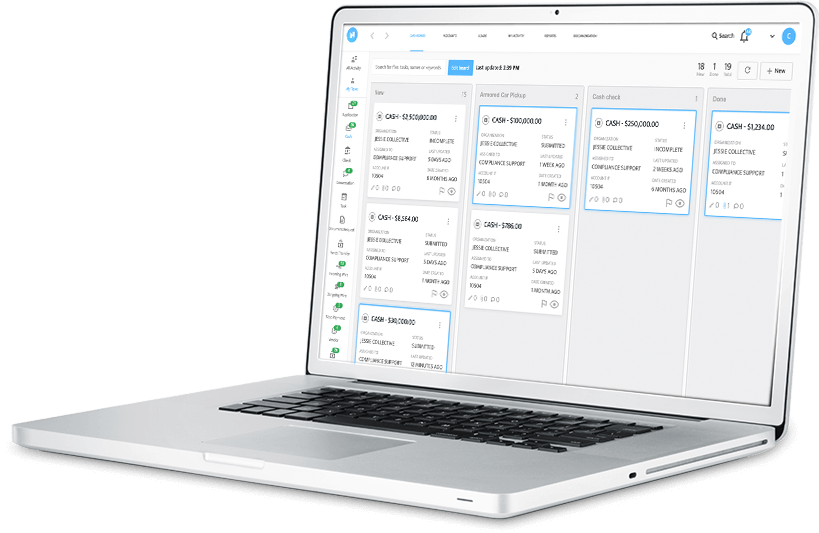

NatureTrak’s state-of-the-art compliance platform is purpose-built for financial institutions serving the commercial cannabis industry. Our innovative technology streamlines efficiencies, so you can grow your cannabis banking program without adding more staff or resources. Plus, you gain access to cannabis banking and regulatory experts that augment your current BSA/AML team and provide the support you need, when you need it.

Validated by NatureTrak

Cannabis-Related Transactions

$2.5+

BILLIONCash Deposits

$900+

MILLIONTax Payments

$250+

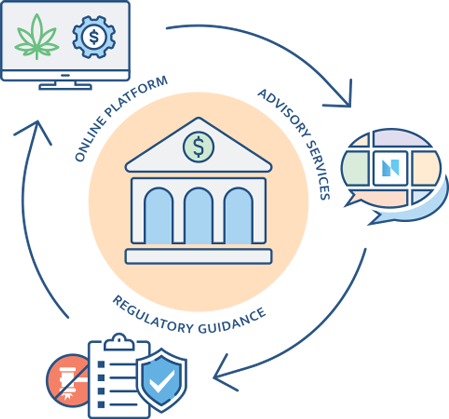

MILLIONA Comprehensive Compliance Solution for Banking Cannabis

Compliance & Risk Management Online Platform

Cannabis Banking

Advisory Services

Regulatory Guidance

& Support

Get Started with NatureTrak!

Schedule a complimentary 30-minute consultation to learn more about NatureTrak’s compliance and risk management solution and discover how serving the emerging cannabis industry can benefit your financial institution.

Customer Testimonials

NatureTrak in the News!

Trusted Partners & Affiliates

Resources

A collection of educational, cannabis-related resources, including white papers, regulatory updates, infographics, and more!

MORE RESOURCES