Why NatureTrak?

Get everything you need to successfully manage your cannabis banking program, all under one roof. Our innovative technology, partnered with our deep expertise in cannabis banking and regulatory guidelines, is the only comprehensive solution for safely and efficiently banking commercial cannabis customers. It’s also the reason why we are the #1 choice of banks and credit unions across the country.

A Comprehensive Compliance Solution for Banking Cannabis

A Technology-First Approach

Our platform is purpose-built for financial institutions with commercial cannabis customers. Direct integrations with core banking systems, track and trace software, and accounting and payments solutions allow for a seamless user experience. Plus, continual development enhancements ensure all industry and regulatory updates are reflected quickly and accurately within the platform.

Tailored Advice for Your Unique Needs

The NatureTrak team has over 30 years of combined experience in cannabis, compliance, banking, and enterprise technology. Not only will NatureTrak configure the online platform to meet your institution’s unique compliance needs, but we can help you create your framework, develop policies and procedures, and train staff to become your in-house cannabis banking experts.

Regulatory Guidance Every Step of the Way

If your financial institution operates in cannabis-legal states, the likelihood that you already have cannabis-related business accounts is high. With NatureTrak you get access to top compliance and risk experts on staff to help ensure your financial institution is compliant with all state and federal guidelines. We are also audit and examination tested—Our customers passed without material findings every time.

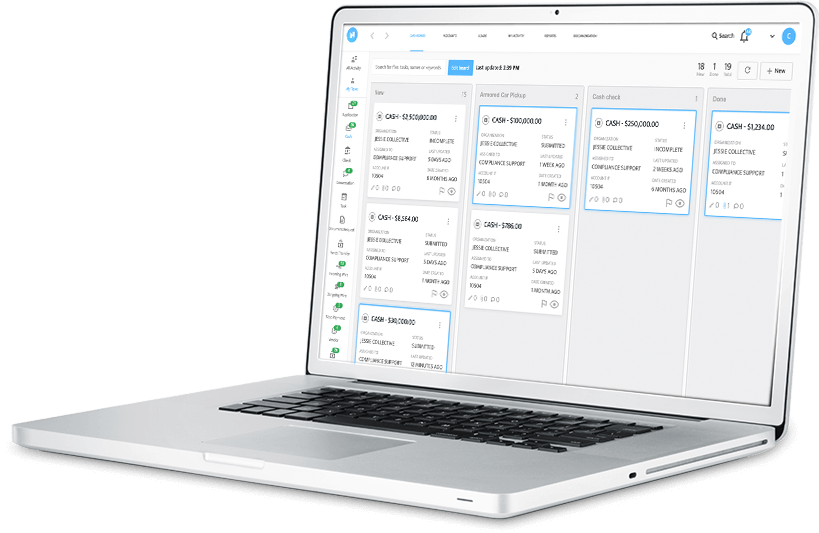

Key Platform Features

Inversion & Diversion Tracking Capabilities

Full integration with track and trace systems and accounting software allows for all cannabis-related transactions to be monitored and verified throughout the supply chain.

Pre-Deposit Validation

All deposits are validated in real-time against the available product inventory preventing unverified funds from ever entering a financial institution.

Integrated License & Entity Verification

License status is authenticated before every system activity to ensure each transaction is associated with a legal government entity.

Marijuana Anomaly Detection (M.A.D.)™

NatureTrak’s proprietary rules-based, AI-powered engine monitors all cannabis-related transactions and flags potential risks or suspicious activities in real-time. Deliberate in approach, the technology was built to actively monitor the entire supply chain because we know money laundering doesn’t just happen at the point of sale. NatureTrak’s Marijuana Anomaly Detection is the foundation of our compliance platform and is the only technology that offers such comprehensive tracking and visibility from seed to bank deposit. Federal, state, and FinCEN guidelines are incorporated by design and kept up to date as regulations change.

Get Your Complimentary Risk Assessment Today

If your financial institution operates in a cannabis-legal state, you likely provide banking services to cannabis-related businesses. Understand your institution’s current risk and discover the benefits that a cannabis-specific compliance and risk management solution like NatureTrak can offer your bank or credit union.

Customer Testimonials

NatureTrak Has Solved Cannabis Banking. Want to Learn More?

Download our fact sheet, Getting to Know NatureTrak, to discover how our enterprise compliance solution can benefit your financial institution today!

DOWNLOAD NOW